Difference between revisions of "Questionnaire Design"

| Line 10: | Line 10: | ||

== Process and Timeline == | == Process and Timeline == | ||

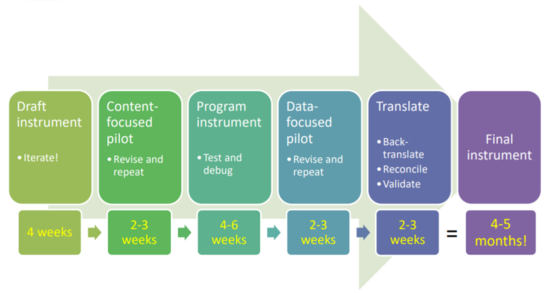

The figure below highlights the steps involved in '''questionnaire design''', along with the time that the [[Impact Evaluation Team|research team]] should allocate to each step. The entire process can take 4-5 months. | The figure below highlights the steps involved in '''questionnaire design''', along with the time that the [[Impact Evaluation Team|research team]] should allocate to each step. The entire process can take 4-5 months, and this includes revising and and reviewing the '''survey instrument''' based on feedback from the [[Survey Pilot|survey pilot]]. | ||

[[File:Questionnaire.png|550px|thumb|center|'''Figure : Questionnaire design timeline''']] | [[File:Questionnaire.png|550px|thumb|center|'''Figure : Questionnaire design timeline''']] | ||

Revision as of 20:11, 10 June 2020

Questionnaire design is the first step in primary data collection. A well-designed questionnaire requires planning, literature reviews of questionnaires, structured modules, and careful consideration of outcomes to measure. Questionnaire design involves multiple steps - drafting, content-focused pilot, programming, data-focused pilot, and translation. This process can take 4-5 months from start to finish, and so the impact evaluation team (or research team) must allocate sufficient time for each step.

Read First

- The drafting stage should align the survey instrument (or questionnaire) with the key research questions and indicators.

- Carefully review existing survey instruments that cover similar topics before starting.

- Divide the questionnaire into modules - this makes it easier to structure the instrument.

- Think through measurement challenges during questionnaire design.

- To avoid recall bias, use objective indicators as much as possible.

- Recall bias is a type of error that occurs when participants are not able to accurately remember past events.

Process and Timeline

The figure below highlights the steps involved in questionnaire design, along with the time that the research team should allocate to each step. The entire process can take 4-5 months, and this includes revising and and reviewing the survey instrument based on feedback from the survey pilot.

Draft Instrument

Drafting the instrument is the first step of the questionnaire design workflow. This section describes the various guidelines and aspects of drafting a survey instrument. As a general rule, the questionnaire must always begin with an informed consent form. The remote or field survey can start only after a survey participant agrees to participate. To make the process of drafting easier and more structured, the research team should divide the instrument into modules, and perform a literature review of existing questionnaires.

Modules

In the drafting stage, it is helpful for the research team to start by outlining the various modules that they want to include in the instrument. Follow these steps to structure the modules:

- Theory of Change. Start by drafting and reviewing a theory of change, and prepare a pre-analysis plan. Use the inputs from the members of the research team for this step.

- Outline. Based on the theory of change and pre-analyis plan, prepare an outline of questionnaire modules. The modules should align with the key research questions. Take feedback from the other members of the research team.

- Outcomes of interest. Then, for each module, make a list of all intermediary and final outcomes of interest, as well as important indicators to measure. Again, take inputs from members of the research team, as well as other implementing partners who have prior experience in preparing survey instruments.

- Relevance and looping. Based on this list, discuss relevance and looping for each module. For example, for a survey on households, relevance means asking if a particular module applies to all households. Looping means considering if the questions within a module should be asked to all members in the household.

- Questions. Finally, discuss and draft questions for each module. Do not start from scratch, even if the instrument is for a baseline survey (or first round).

Literature Review

When drafting questions for each of the modules in an instrument, do not start from scratch. Follow these steps to draft the questions:

- Literature review. Start by performing a literature review of existing, reliable, and well-tested questionnaires. Examples of such questionnaires include field or remote surveys in the same country (regardless of the sector), or in the same sector (regardless of the country).

- Compile. Use this review to compile a repository or bank of relevant questions for each module.

- Cite source. In the draft version, add a separate column to note the source of each question. Again, take feedback from the other members of the research team and implementing partners.

You can consult the following resources for the literature review:

- World Bank microdata catalogue

- J-PAL microdata catalogue

- Demographic and Health Surveys (DHS) microdata catalogue

- IFPRI microdata catalogue

- International Household Survey Network (IHSN) survey catalogue

Note: While drafting the instrument, it is also important to keep in mind that certain indicators can be hard to measure. This can lead to certain measurement challenges.

Challenges to Measurement

Measurement challenges arise when certain indicators that are important to answer key research questions are hard to measure. It is important for the research team to discuss these, and find a way to resolve these challenges. The following are some of the challenges to measurement, along with suggestions to resolve them.

Nuanced definitions

In some cases, questions which seem straightforward can actually be quite nuanced or complex. Consider the following examples:

- Example 1. While questions about household size seem straight-forward, the answer can differ depending on which definition of household member is used. Without any further clarification, household member can include one, or all of the following - anyone currently living in the household, anyone who has lived more than 6 of the last 12 months in the household, domestic workers, children who are studying in another location but are economically dependent on the household, and adults who live in another location but send monthly remittances.

- Example 2. While it may seem that all respondents should know their age, age can be difficult to measure if respondents do not have birth certificates, do not know their birth year, or are innumerate

To deal with such cases, the research team can take the following steps:

- Pay careful attention during the survey pilot, and identify questions that may be hard to understand for the respondent.

- Adjust the questionnaire accordingly, and train enumerators to resolve these concerns.

- Change the wording of the questions so the meaning is clear, and include definitions within the questionnaire where necessary to make sure all respondents have the same information at the time of answering a question.

Recall bias and estimation issues

Recall bias is bias that arises when a question asks respondents to estimate or recollect events that happened in the past. In such cases the answers can be incorrect, or incomplete, leading to recall bias. The research team should therefore be careful of recall bias when asking questions related to income , consumption of food, health-related expenditures, profits, and so on.

To avoid recall bias, use the following strategies :

- Avoid the question. Ask a different question, and use objective indicators as much as possible. For example, instead of asking a respondent the size of their agricultural plot, the research team can use geospatial data to find out the size of the plot. Similarly, the research team can try to use administrative data where possible, instead of asking respondents about their income over the previous year.

- Consistency checks. Build in consistency checks into the instrument. For example, if the amount harvested in a year is less than the amount consumed, it means there is a recall bias. In such a case, the enumerators can check with the respondent in real-time, and correct the data.

- Multiple measurements. Measure the same indicator in multiple ways. For example, ask about the time taken to reach the nearest grocery store. Also ask the distance to the grocery store. This can allow the enumerator to compare the two answers, and if they do not make sense, the enumerator can verify with the respondent in real time.

Note: However, it is important to keep in mind that objective indicators are often more expensive to measure, and it may not always be possible to measure them. In these cases, the research team should do the following to ensure data quality:

- Perform internal checks like back checks and high frequency checks during data collection.

- Measure the same indicator multiple times, where feasible. This allows the research team to check if data is consistent across multiple rounds of data collection.

- Use contextual references, like general trends in the study area, to get a reasonable estimate.

Sensitive questions

In some cases, questions often deal with sensitive topics or issues that are considered socially undesirable. For example, respondents may have reasons to not answer, or hide information on topics like drug usage, alcohol consumption, sexual activity, or violent behavior. This can lead to bias in the collected data, and the size and direction of this bias can be hard to predict.

To deal with questions that deal with sensitive topics, keep the following in mind:

- Guarantee anonymity. The enumerators should guarantee anonymity and confidentiality when sharing the informed consent section of the instrument with the respondents.

- Build comfort. The enumerators should first establish a level of comfort with respondents before moving on to the sensitive topics.

- Re-frame the questions. Consider asking the question in third person, framing the questions in a manner that does not make an activity sound socially undesirable.

- Self-administration. Consider the option of respondents answering certain modules themselves, instead of answering them through the enumerator.

- Different methods. Consider using different methods like randomized response technique and randomized lists. These can be useful in getting answers to questions that deal with sensitive topics.

Abstract concepts

It is also hard to measure abstract concepts such as empowerment, risk aversion, social cohesion, or bargaining power. Some of these aspects may be defined differently across cultures, and it might be hard for the research team to identify a definition that works for a particular context.

In order to measure abstract concepts, use the following strategies:

- Define the concept. If a particular concept is hard to define, review existing studies to check if a previous study successfully came up with a definition. If not, then try to consult local experts and partnering agencies to come up with a definition that matches the context. Some of the resources that can help with measuring abstract concepts like empowerment include:

- J-PAL has created a guide on measuring women and girls' empowerment in impact evaluations.

- IFPRI has created a Women's Empowerment Agricultural Index (AWEI), along with an instructional guide that explains the methodology, and steps to adapt the AWEI to local contexts.

- Oxfam has also created a 'how-to' guide to measuring women's empowerment.

- Choose outcome. After finalizing a definition, choose the outcome that can measure that concept.

- Design a measure. Finally, design a good measure for that outcome. For example, consider a question like - do you and your partner consult each other when taking decisions about your child? If the answer is Yes, it can be a measure of empowerment.

Final Instrument

After completing the draft stage, the research team must plan the next steps in the questionnaire design workflow - conduct a content-focused pilot, program the instrument, conduct a data-focused pilot, and finally, translate the instrument.

Once these steps are complete, the research team can save and store the final version of the instrument. Note that the final version is not the programmed version. The following are some of the best practices for the final version of the instrument:

- Informed consent. Start the instrument with an informed consent section. Make sure that the interview (CAPI or CATI) cannot continue if the respondent refuses to participate in the interview.

- Unique ID. Identify each respondent and each completed instrument with a unique ID.

- Excel workbook. Store the final version as an Excel workbook, with one tab for each module. Keep one main tab that contains all the modules, which will be used for programming. Link the cells which have questions from each tab to the main tab.

- Introductory script. Write an introductory script for each module, to guide the flow of the interview. For example - "Now I would like to ask you some questions about your relationships. I do not want to invade your privacy. We are simply trying to learn how to make young people’s lives safer and happier. We request you to be open to our questions, because for our work to be useful to anyone, we need to understand the reality of young people’s lives. Remember that all your answers will be kept strictly confidential."

- Correctly code answer choices. All questions should have answer choices that are correctly and consistently coded. For example, throughout the instrument, use -9 for "Other", -8 for "Do not know", and -7 for "Prefer not to answer". The answer choices should be complete, that is, they must cover all possible responses that can exist for a question.

- Provide helpful hints. Include hints wherever necessary to help the enumerator. These hints should typically appear in italics to clarify that they are not part of the question that is read to the respondent. For example, consider the question - "for how many months did you work in the last 12 months?". In this case, the hint can appear as follows - Hint : Enumerator, if less than 1 month, round up to 1.

Related Pages

Click here for pages that link to this topic.

Additional Resources

- David McKenzie (World Bank), Three New Papers Measuring Stuff that is Difficult to Measure

- DIME Analytics (World Bank), Survey Instruments Design & Pilot

- DIME Analytics (World Bank), Preparing for Data Collection

- DIME Analytics (World Bank), Survey Guidelines

- DIME Analytics (World Bank), SurveyCT) Guide for Data Collectors

- Diva Dhar (JPAL-IFMR), Instrument Design 101

- Grosh and Glewwe (World Bank), Designing Household Survey Questionnaires for Developing Countries: Lessons from 15 Years of the Living Standards Measurement Study

- Simone Lombardini (Oxfam UK), FAQ - How can I measure household income (Part 1)

- Zezza et al. (World Bank, FAO, IFPRI), Measuring food consumption and expenditures in household consumption and expenditure surveys (HCES)